.406 Ventures, a Boston-based enterprise firm investing in enterprise-focused startups in healthcare, data and AI, and cybersecurity, closed its fifth fund with $265 million in capital commitments.

The firm was founded by Liam Donohue, who was the founding father of Boston enterprise firm Arcadia Partners, and two other partners, including Maria Cirino, co-founder of the managed-security services company Guardent, and former Razorfish CFO Larry Begley.

The brand new fund is backed by a gaggle of latest and existing limited partners, including university endowments, foundations, pension plans and strategic investors. Including the brand new fund, the 18-year-old firm has raised greater than $1.4 billion across its five core funds and three opportunity funds.

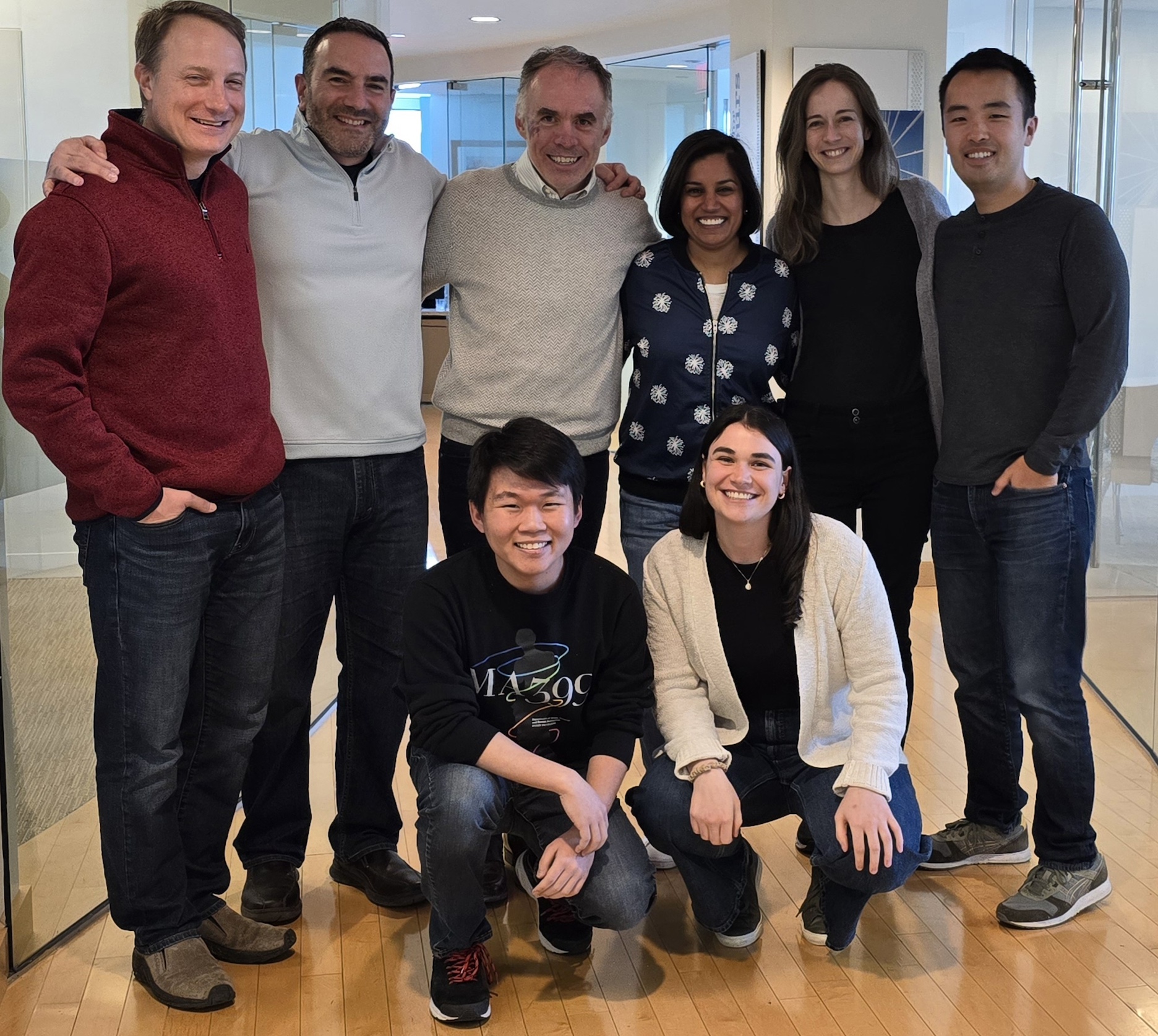

.406 Ventures investing team: Standing, from left, Graham Brooks, Greg Dracon, Liam Donohue, Payal Agrawal Divakaran, Kathryn Taylor Reddy and Kevin Wang. Kneeling, from left, Austin Kwoun and Rebecca Redfield. Missing from photo: Trip Hofer. Image Credits: .406 Ventures

It’s been awhile since TechCrunch caught up with the firm. Speaking recently with Donohue, he said .406 Ventures’ focus hasn’t modified much during that point. The firm continues to speculate in those self same three industries and leverages the Boston tech ecosystem, though it does invest nationally.

Nonetheless, unlike a few of the firm’s previous funds, Donohue is seeing more repeat founders coming back for brand spanking new investments.

“We desired to be a partner in order that a founder would come back to us for his or her next thing,” Donohue told TechCrunch. “In funds one and two, we had a few repeat founders. Within the more moderen funds, I’m excited to see so many great repeat partners coming back that a 3rd of the fourth fund was repeat founders, and I’d expect in regards to the same in fund five.”

Over the 20 years, the firm has put together a portfolio of 87 firms, a lot of which have exited or gone public. Most recently those have included Iora Health, acquired by OneMedical in 2021 and now a part of Amazon Health. Behavioral health company AbleTo is under Optum Health. Meanwhile, Carbon Black and CloudHealth Technologies are a part of VMware while cybersecurity insurance company Corvus was acquired by Travelers in 2023.

.406 Ventures has already made investments in 4 firms from the brand new fund, including Portrait Analytics, the developer of a generative AI platform for investment research and thesis creation. It’ll put money into greater than 20 firms with the brand new fund, Donohue said.

When startups throughout the three verticals of healthcare, data and AI, and cybersecurity, the firm considers quite a few aspects, just like the plan for infrastructure, especially now that AI is in all places. It also taps into executive councils of over 100 C-suite operators from Fortune 500 firms.

“We ask ourselves, ‘What are the brand new technologies which can be either going to should be protected or will enhance and alter the threat aspects?’ Donohue said. “We’re all the time looking forward three to 5 years and anticipating where the vulnerabilities are going to be after which who’s constructing the protections for this.”