In the event you’ve ever played free-to-play video games in your phone, you’ll have seen an advert or two, including mini-games and other content with variable quality and relevance.

That’s the space where Incymo operates; it guarantees to leverage machine learning and other smarts to maximise promoting revenues for game publishers, promising its users a 30% increase in average revenue per user (ARPU) from recent users and a ten% increase to paying customers.

In a market of big numbers, where every penny counts and each percent can have an incredible impact on the sport firms, those figures caught the eyes of Incymo’s investors.

We decided to take a more in-depth take a look at its deck to see whether we’d have reached for our checkbooks or the massive, red “pass” button.

Slides on this deck

Incymo AI’s deck has only 12 slides, so the corporate must make every slide count. Here’s what’s included:

- Cover slide

- Problem slide

- Solution slide

- Traction slide

- Customer slide

- Business model slide

- Market size slide

- Market trajectory slide

- Goals/targets slide

- Team slide

- “The ask” slide

- Road map slide

Three things to like

There’s loads to like about Incymo’s slide deck. The design is fresh and it includes lots of the key facets we’d expect to see in a pre-seed deck.

An infinite market

[Slide 7] That’s an enormous TAM. Image Credits: Incymo

No person goes to argue with Incymo that marketing for video games is a giant market, and the corporate gets partial credit for showing off the assorted ways of calculating the TAM and SOM — on this case, top-down and bottom-up.

The $72 billion per yr TAM is hugely naive, bordering on absurd.

Having said that, the top-down calculation appears to be “every game on the Google Play and Apple App store, multiplied by the $4,000 we’d charge them per 30 days, multiplied by the variety of months within the yr.” It’s a daring calculation, and I can see how the corporate got there, but even when it were to execute with 100% perfection, there’s going to be an enormous variety of games that may’t or won’t be customers.

The $72 billion per yr TAM is hugely naive, bordering on absurd. On the one hand, it doesn’t really matter: The deciding factor is whether or not the corporate has a giant market, and I agree it probably does. Nonetheless, any executive team that’s taking this approach to calculating a TAM is showing its hand as being pretty unsophisticated.

The underside-down SOM, nonetheless, can also be pretty unsophisticated. If I’m reading this slide right, the corporate is actually saying, “We’ve 600 people in our sales pipeline, so our obtainable market is to convert all of them at $4,000 per 30 days.” That also isn’t realistic for quite a few reasons: No company ever converts all of its leads, and this SOM seems to point that there’s a maximum of 600 customers going into the highest of the funnel. An organization that may’t top up its leads over time is doomed to stagnate.

Look, I 100% imagine that Incymo is in a big market and that it might probably find enough customers to make this worthwhile, however the slide deck is a chance to point out your would-be investors that you simply understand the financial levers in your online business. These slides seem to point the other; not an excellent look.

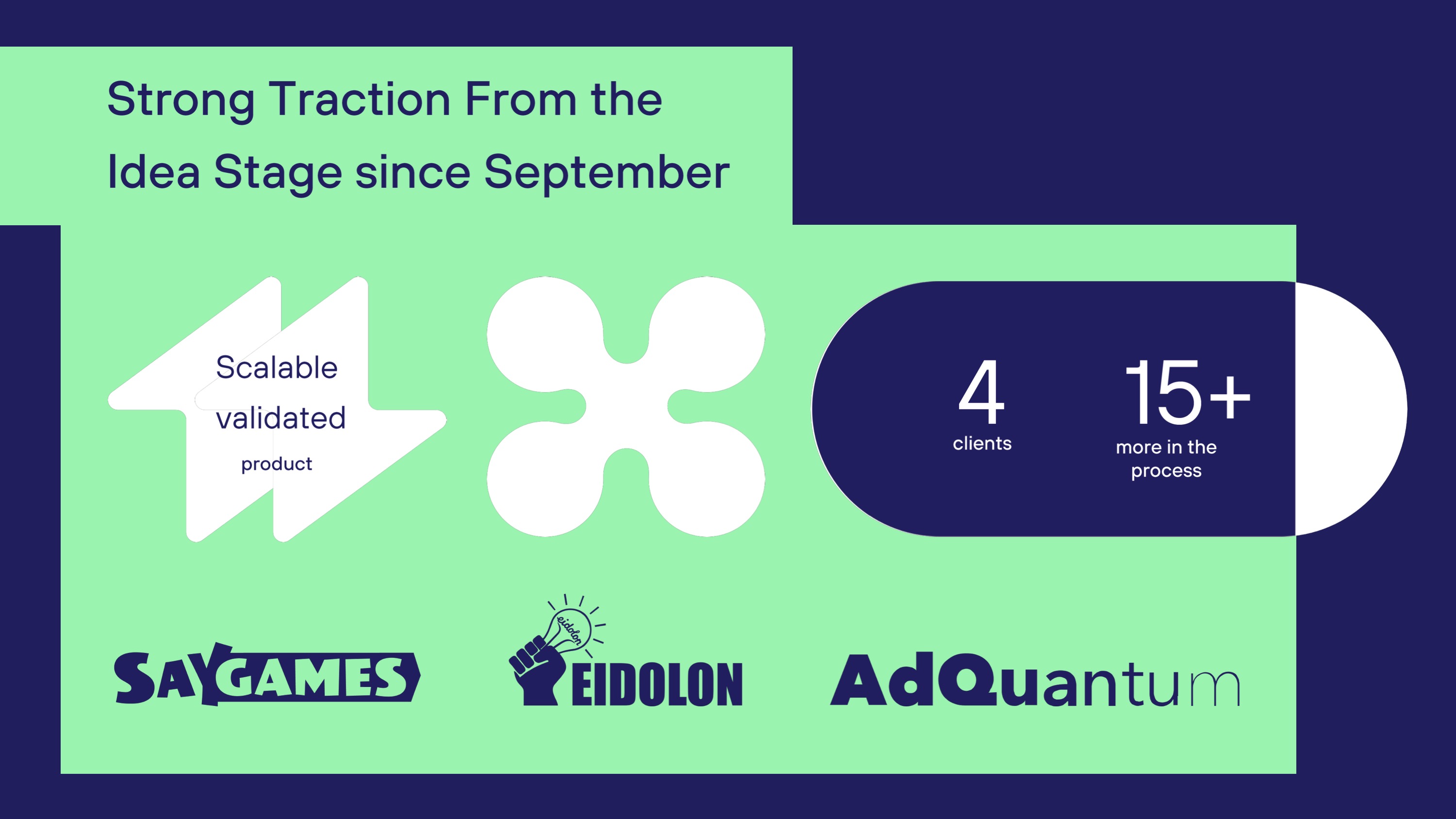

Traction is king

[Slide 4] Traction beats all else. Image Credits: Incymo

Loving the strong traction headline — it’s certainly one of the things that investors care about greater than the rest. I wish the corporate showed its traction by metrics apart from “variety of clients” and “more clients in the method” — it could have been more powerful to point out revenue or results, for instance.

There’s an enormous difference between signing up major game studios that wish to use your product across its entire portfolio of games and signing up a skunkworks in the identical game studio that’s running a pilot and signing up an indie developer. On certainly one of the opposite slides, Incymo mentions that a few of the game firms have $20 million annual marketing budgets. Awesome, nevertheless it doesn’t connect the dots to say whether it has actually certainly one of those firms.

The opposite thing I find myself stumbling over on this slide is the “15 more in the method.” Which means very various things to different firms. Anyone who’s done B2B sales knows that a healthy sales pipeline is the alpha and omega of a successful sales operation. Having someone “in the method” could mean anything — and without closer qualification, it’s dangerously near being yet one more vanity metric.

A somewhat clearly defined problem/pain point

[Slide 2] Gotta love a clearly defined problem. Image Credits: Incymo

There’s little doubt that marketing for mobile games is cutthroat and supremely competitive. The difference between the No. 3 and No. 6 slots on the app charts is vast, and a variety of these firms are spending eye-watering amounts of cash to fight their option to the highest.

I 100% imagine it when the corporate says that it has found that its goal customers (gaming user acquisition marketers) are spending a variety of time iterating on ads that perform well. A sample size of 20 seems a bit low for this slide, so I’d like to have seen some barely more comprehensive numbers, but that doesn’t reduce the clarity of the issue statement. (Though the grammar leaves a thing or two to be desired.)

So. Those were a few of the things we found about this pitch deck, and also you perhaps noted we still added caveats. In only a moment, we’re about to get loads saltier and take a look at a number of things Incymo could have improved or done otherwise, together with its full pitch deck!

Strap in; it’s going to be quite the ride.