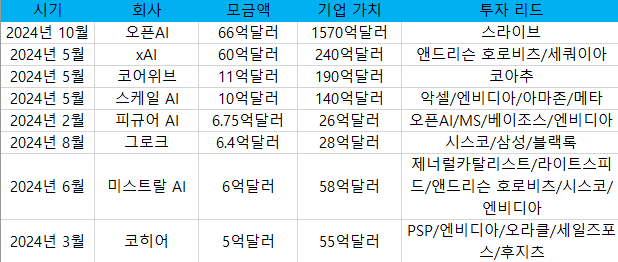

It was revealed that the investment boom within the generative artificial intelligence (AI) field has turn out to be stronger this yr, including the recently accomplished investment of $6.6 billion in Open AI. Particularly, eight large-scale investment rounds value greater than $500 million (roughly KRW 670 billion) were conducted.

On the 4th (local time), Reuters cited data from the London Stock Exchange Group (LSEG) and revealed cases where investments exceeded $500 million were recorded this yr.

The combined amount raised by OpenAI and xAI amounts to a whopping $12.6 billion (about 17 trillion won).

In corporate valuation, OpenAI ($157 billion) is greater than six times greater than xAI ($24 billion). Nonetheless, xAI, which has only been established for a yr, has achieved results that may be called overrated. It is because the values of Coreweave and Scale AI, that are about to be listed, are $19 billion and $14 billion, respectively.

Generative AI hardware firms, similar to CoreWeave, a cloud service provider backed by NVIDIA’s GPU support, and Groc, which produces AI chips dedicated to inference, have also succeeded in making large-scale investments.

Mistral AI, a number one French AI startup, is understood to have raised a complete of $1.081 billion this yr alone by conducting one other investment round along with $600 million.

Reuters explained that this shows that the investment craze for generative AI startups that broke out after the launch of ‘ChatGPT’ at the top of 2022 continued this yr.

Also on the identical day, The Information cited data from Pitchbook and the American Enterprise Capital Association and reported that U.S. startups raised $37.5 billion (roughly 50.5 trillion won) throughout the first to 3rd quarters, an 8% increase in comparison with the previous yr. It was analyzed that this was the results of large-scale transactions regarding AI.

This includes the case of Anduril, a defense AI company that raised $1.5 billion last August. Moreover, this transaction by OpenAI was excluded. Due to this fact, total investment in 2024 is predicted to extend significantly in comparison with the previous yr.

In actual fact, up to now few days because the Open AI investment announcement, related news has been pouring in.

Following AI coding startup Poolside raising $500 million from NVIDIA and eBay, Cisco plans to speculate in CoreWeave at a worth of $23 billion. AI voice startup Eleven Labs is negotiating an investment value $3 billion.

Also, it was recently reported that Antropic began raising funds with a worth of as much as $40 billion (about 54 trillion won).

Nonetheless, investments are inclined to be concentrated in startups developing some frontier models. In actual fact, Character.AI, Inflection AI, and Adept failed to boost funds and handed over their key personnel to Big Tech.

Meanwhile, last yr, two major AI investment examples were Open AI, which attracted $10 billion from Microsoft, and Antropic, which attracted greater than $6 billion from Amazon and Google.

Reporter Lim Da-jun ydj@aitimes.com