“That could be a huge liability and credit risk for Oracle. Your important customer, biggest customer by far, is a enterprise capital-funded start-up,” said Andrew Chang, a director at S&P Global.

OpenAI faces questions on the way it plans to satisfy its commitments to spend $1.4 trillion on AI infrastructure over the following eight years. It has struck deals with several Big Tech groups, including Oracle’s rivals.

Of the five hyperscalers—which include Amazon, Google, Microsoft, and Meta—Oracle is the just one with negative free money flow. Its debt-to-equity ratio has surged to 500 percent, far higher than Amazon’s 50 percent and Microsoft’s 30 percent, in keeping with JPMorgan.

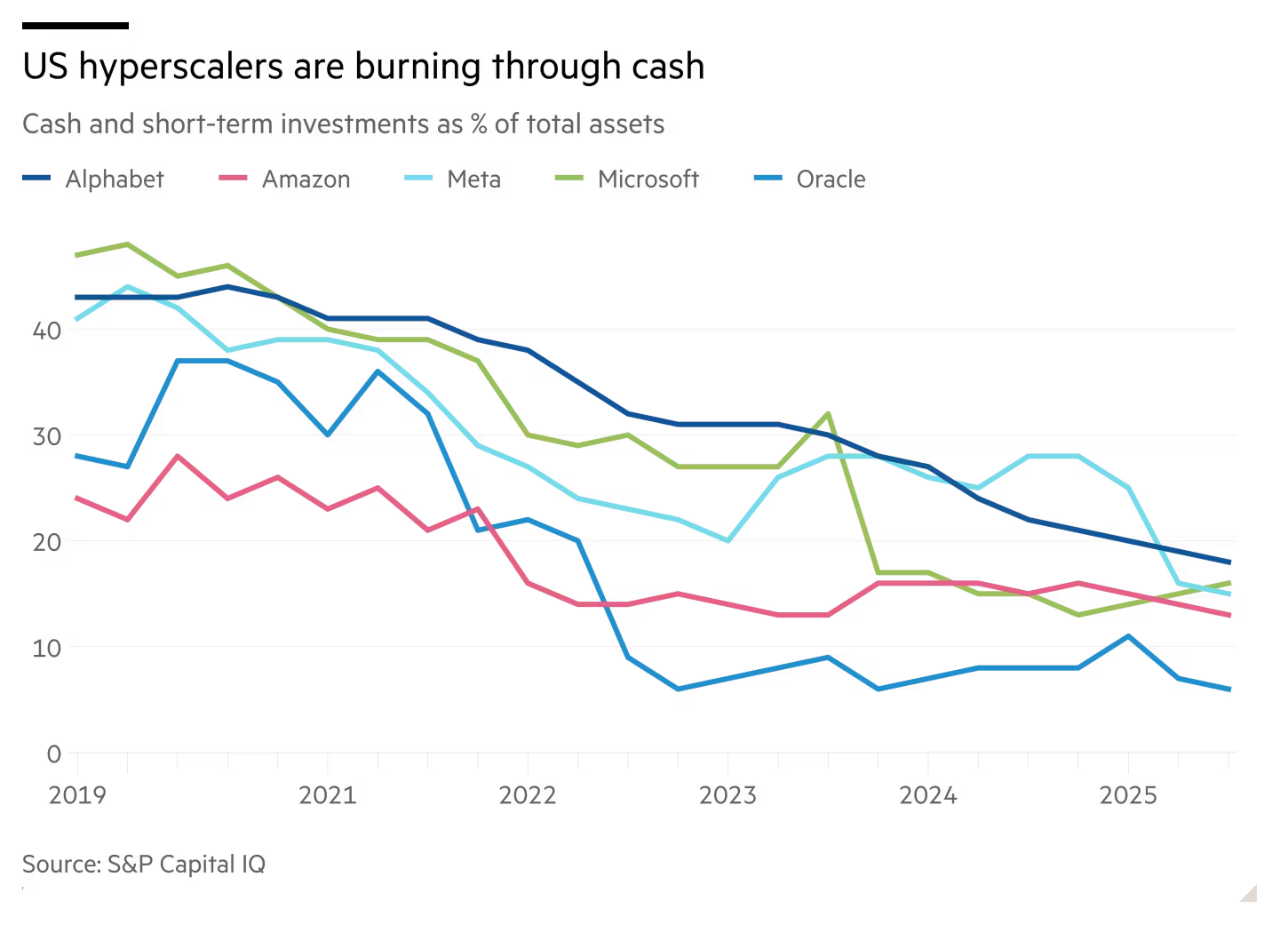

While all five corporations have seen their cash-to-assets ratios decline significantly in recent times amid a boom in spending, Oracle’s is by far the bottom, JPMorgan found.

JPMorgan analysts noted a “tension between [Oracle’s] aggressive AI build-out ambitions and the bounds of its investment-grade balance sheet.”

Analysts have also noted that Oracle’s data center leases are for for much longer than its contracts to sell capability to OpenAI.

Oracle has signed a minimum of five long-term lease agreements for US data centers that can ultimately be utilized by OpenAI, leading to $100 billion of off-balance-sheet lease commitments. The sites are at various levels of construction, with some not expected to interrupt ground until next yr.

Safra Catz, Oracle’s sole chief executive from 2019 until she stepped down in September, resisted expanding its cloud business due to the vast expenses required. She was replaced by co-CEOs Clay Magouyrk and Mike Sicilia as a part of the pivot by Oracle to a brand new era focused on AI.

Catz, who’s now executive vice-chair of Oracle’s board, has exercised stock options and sold $2.5 billion of its shares this yr, in keeping with US regulatory filings. She had announced plans to exercise her stock options at the tip of 2024.

© 2025 The Financial Times Ltd. All rights reserved. To not be redistributed, copied, or modified in any way.