In accordance with an evaluation, Big Tech’s annual investment in the substitute intelligence (AI) boom is $600 billion (about 830 trillion won), but its profits are lower than $100 billion (about 138 trillion won) at best. Recently, specific figures have been mobilized to warn against the blind investment being made in Nvidia and AI.

Tom’s Hardware cited a report by David Kahn, an analyst at Sequoia Capital, on the fifth (local time) claiming that AI corporations must earn about $600 billion annually to cover the prices of AI infrastructure corresponding to data centers.

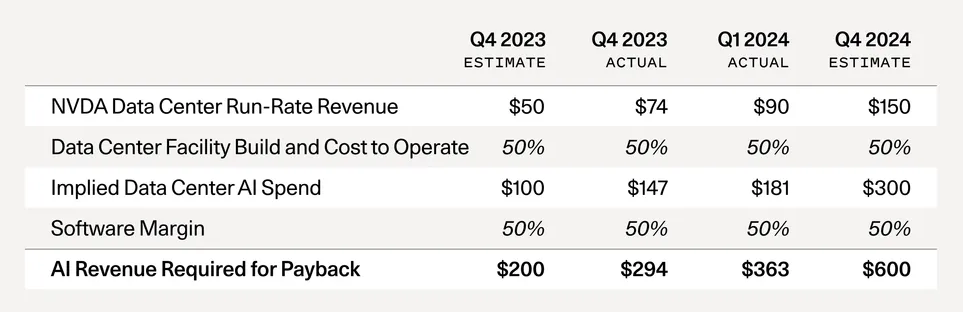

Last September, Kahn analysts also published an evaluation titled “AI’s $200 billion gap.” This yr, the gap has tripled.

The mathematics on cost is easy. In accordance with Kahn, Nvidia earned $47.5 billion last yr from data center hardware revenue, namely GPUs and the like. This yr, that figure is predicted to grow to $150 billion.

Here, as the development of Big Tech data centers increases, the associated fee of land, construction costs, and energy facilities is predicted to be as high as the associated fee of GPUs. In other words, this yr, 300 billion dollars shall be spent on data centers alone.

Then, it doubled that. This reflects that the top users of GPUs, cloud corporations, startups, and enterprises, also must make 50% profit to cover labor costs and operating expenses. This evaluation shows that the overall cost of AI shall be roughly $600 billion this yr.

Nonetheless, there aren’t many corporations that become profitable with AI.

The startup that has recently performed the perfect with AI revenue alone is OpenAI. Its annual revenue, which was $1.6 billion (about 2.2 trillion won) at the top of last yr, greater than doubled to $3.4 billion (about 4.7 trillion won) this yr. The opposite startups are struggling to succeed in $100 million in revenue.

We’ve got made essentially the most optimistic predictions for Big Tech’s AI-related revenue this yr. If Microsoft (MS), Google, Apple, and Meta each earn $10 billion a yr, and Oracle, ByteDance, Alibaba, Tencent, and Tesla each earn $5 billion, the overall revenue shall be lower than $100 billion.

Even when we take a look at it optimistically, the conclusion is that there shall be a difference of 500 billion dollars between income and expenditure.

Particularly, AI revenues are seen as too variable. As competition in services intensifies, as is currently the case in China, there may be a high possibility that price cutting war will occur.

GPUs, unlike existing physical infrastructure, also identified that the value system could collapse with the emergence of recent AI chips. Actually, AMD and Intel, in addition to cloud corporations and plenty of startups, are producing AI chips.

Ultimately, he predicted that while AI has transformative potential and corporations like Nvidia are playing a key role, the road ahead shall be long and difficult as enterprises and startups have yet to deliver revenue-generating applications.

Nonetheless, Kahn said, “AI will create enormous economic value, and corporations like Nvidia will likely play a major role within the ecosystem for a very long time,” adding, “Speculative hype is an element of technology, so there is no such thing as a should be afraid.”

Nonetheless, he said, “We must watch this moment with a cool head, lest we imagine the delusion that has spread from Silicon Valley to the nation and the world: that artificial general intelligence (AGI) will occur tomorrow and that we’ll all get wealthy quickly because we’d like to stockpile the one precious resource we now have – graphics processing units (GPUs).”

Finally, he concluded, “The road ahead shall be long indeed. There shall be ups and downs,” but “it would almost actually be value it.”

Reporter Im Dae-jun ydj@aitimes.com